The Omaha EITC Coalition advances financial empowerment, asset development and community prosperity for low to moderate income families through quality volunteer tax return preparation, community partnerships, and strategies to improve savings.

We administer tax preparation locations for the IRS through the Volunteer Income Tax Assistance (VITA) program in the Greater Omaha Metro area. The VITA program also provides credit advising for low-income families, and other asset-development opportunities through FHAS and the Coalition’s 40 partners.

Appointment Alert!

Appointment reminder emails have had an incorrect address on them! If you received a reminder email with the Bellevue address but made your appointment at a different location, your appointment IS at the location you selected. The reminder email still has the correct site name on it. Please go to the correct site for your appointment. We are so sorry for the confusion!

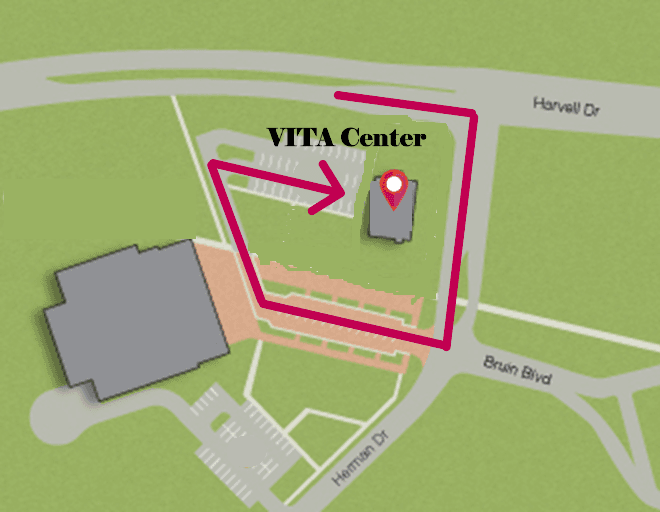

We have moved! The VITA center is our new all-year tax program location!

2108 Harvell Circle, Bellevue, NE 68005 (Rotert Building)

Enter through the Field House parking lot (see map below)

You may schedule an in-person appointment here or by calling 211 when the calendar is open.

Tax preparation will begin January 26, 2026.

We also have an online option, Tax360 SecureDrop, to have your taxes prepared remotely. you may start uploading documents at any time, but tax preparation will not begin until the last week of January.

Not sure which to choose? Take a quiz to find out!

Volunteer Income Tax Assistance (VITA) is for low-to-moderate income taxpayers, typically families earning $65,000 a year or less.