|

Would you like to learn a little more first? Every new volunteer must attend an orientation session. Orientation are held in the fall and winter. Click to learn more! ->

|

Site Navigator

Site Navigators handle customer intake (checking identifications, handing out in-take forms, managing the waiting list), explain the consent process and offer additional services at our sites through our “Money Menu.” Training is required and regular volunteer courses (16-hours in length) are set in December and January of each year. IRS requirements for this role require the passing of an ethics exam and enrollment as a volunteer through the Omaha EITC Coalition.

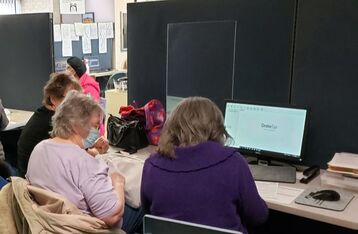

Tax Preparer

Tax Preparers meet one-on-one with customers and complete a thorough interview to understand the customer's situation and needs. The Federal and state tax returns are completed with participation from the customer. Training is required and regular volunteer courses (60-hours in length) are scheduled for September-December of each year. IRS requirements for activity in this role require the passing of an ethics exam, Advanced Certification in tax law, and enrollment as a volunteer through the Omaha EITC Coalition.

Hear from our current volunteers!

Patrice, Certified Tax Preparer |

Johnny, Site Navigator |

Ready to make a difference? Fill out an application today and a team member will reach out to you shortly!

|

About Us

Family Housing Advisory Services, Inc., (FHAS) provides top-notch impact-oriented housing services to about 9,000 low-to-moderate income individuals annually, changing lives, revitalizing communities, and developing lifelong skills. |

FHAS Services

|

Lake Point Center

|